As GST impact intensifies, some sometimes offer “fixes” – despite knowing it was unjustified because the taxes it replaced exceeded the annual goal in just 6 months, before it was forced into force in 2022.[1] Others asked, “Why fight the British for repeal? Can’t we just lower it, since 13% seems too high?” A few suggested “Sales Tax” as well as “Income Tax” in a nation of entrepreneurs that rarely pay themselves nor keep records to do so.

Political gurus are guessing that GST will be lowered “just to get re-elected” – or that repealing it must be promised to “get elected” – in another referendum on GST and a generation of fiscal dereliction. Some also envisioned exemptions with elaborate economic and social considerations. And yet, too many fail to ask, why replace one unjustified tax with another in the first place?

Is It Just about Money? Here’s a Test.

Is It Just about Money? Here’s a Test.

Here’s a question for anyone thinking the “real GST issue” is about taking 13% of every transaction every day on everything. Which would you choose? A, or B?

A) GST at 1%, knowing it could go back to 13% or 23% or any other rate at any time?

B) Repeal GST and reinstate the taxes it replaced (since they exceeded the revenue goal in half the required time)?

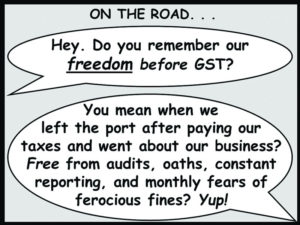

More than Money: Remember Our Freedom Before GST?

Anyone who chose “A” and wants to “fix” GST is surely suffering a short memory! GST legislation abolished our freedom of commerce and countless civil rights.

“Freedom” is defined as, “The state or fact of being free from servitude, constraint, inhibition, etc.; liberty.” [2] Every business leader forced to register as an unpaid GST tax agent within its constraints has been bound into a form of legal servitude.

We are repeatedly reminded that “no person, class of persons, transaction, class of transaction, import, or class of import is exempt from GST except as provided in this Act…” [3] Thus, we are all constrained and inhibited, without freedom of commerce – susceptible to intrusions and capricious changes, whether a registered business or private citizen.

Remember Freedom of Commerce After Leaving the Port?

Remember how merchants, restaurateurs, contractors, counselors – everyone was free to offer products and services without being forced to report every cent they spent or earned? Every entrepreneur and enterprise could thrive knowing that once they cleared their goods, supplies, food – even their staples, ink, and printer paper, they were accountable only to their customers and staff to ensure the quality of their work and wares in a competitive marketplace. Once duties and fees were paid, all could literally go about our business after leaving the port. Hey, Sales and Income Tax “fixers” – this is for you: Why would you adopt any tax that follows you back to your business?

Remember Freedom from Frequent Fear of Fines?

Tyrannical tales abound about tardy monthly GST returns, even by hours, with legitimate reasons (including persistent pay portal problems) – and being forced to pay $500 per day (even for credits), plus 20% of whatever they owed, if anything at all. In addition to requiring 7 years of records retention, that array of GST civil penalties also includes being fined $100 per day for failure to “keep proper records” – at the Comptroller’s discretion! [3]

While criminal penalties apply mainly to conviction for things only fraudsters might do, merely failing to notify the Comptroller of “cessation” of taxable activity, to file a return (perhaps forgotten?), or to maintain “proper” records are among numerous GST infractions assigned frightening fines. Ranging from $500 a day, to many at $5,000, some soar from $10,000 to $25,000, up to $100,000 – plus imprisonment from 3 months to 3 years! So, still feeling free with GST as the “law of the land”?

Remember Freedom from Intrusive Inspections?

Many have also heard of hours-long interrogations examining every penny ever earned or spent and every receipt and record ever received or sent. All true. “The Comptroller may, for any purpose under any part of this act, order a routine audit of the accounts of a taxable person or any other person.” [3] And auditing any time during normal hours, and taking copies, records or computers is still in there. Who is “any other person”? So, let’s say your lawyer provided legal services, what about your family, property, or other business privacy if they were audited?

Remember Freedom from Forced GST Examination on Oath?

Don’t have a lawyer? It may be time to get one! Why? GST empowers the Comptroller to “require a person, whether or not liable for tax …to furnish such information concerning that person or any other person…[and to be] examined on oath” and to “produce any record or computer …relevant to the examination.” [3] So, what if that person is your lawyer put under oath about your affairs? Notably, accessing public legal services is not required in the law, nor protection from self-incrimination.

Remember Freedom from Arbitrary Assessments?

The Comptroller also has 5 years to decide if he is “not satisfied with a return or any other document” and make GST assessments based on his “opinion”! [3] Oh, not happy with that?

There’s more ? in the Objections section: “Where a person disputes the amount of GST to be paid, such person shall be required to pay 50 percent of the amount disputed… before the Comptroller considers such objection.” [3] Psst. GST even put a price on our freedom to appeal.

And…Remember Freedom from Random Resolutions?

Meanwhile, the “Minister may make regulations to…amend the Schedules…or increase or decrease any monetary amount set out in this Act.” [3] It lists 25 sections subject to regulation by House resolution. And he can “make regulations… whether or not to be prescribed by regulations… for any matters necessary or convenient…” to impose GST.

Thus, they could lower GST to 1% today! They could likewise force everyone to register by lowering the threshold to $1 – or raise late fines to $5,000 plus 50% tomorrow! After the election, they could raise GST to 17%, or 27%, like VAT in Hungary. All by House resolution whenever they overspend or add debt again! Wow.

So. Instead of “fixing” GST, remember they repealed and replaced: Accommodation, Communication, Environmental, Promoter taxes and 9% Duty in a single trip to the House (and passed GST with appointees’ votes!) Now, after four amendments [4], GST servitude has intensified, not abated. And far too many have lost the freedom to buy enough to eat.

The only way to “fix” GST is to repeal it and reinstate the proven taxes it replaced – in just one trip to the House. Only then can we all remember the freedom we enjoyed before GST.

Repeal GST – and pass a balanced budget bill. Now.

This article reflects cultural and economic issues raised on July 5, 2021, at the House Select Committee on GST Public Hearing. [1] GOA 2023 Budget;[2] https://www.oed.com/dictionary/freedom_n?tl=true; [3] Goods and Services Tax Act 2021; [4] https://ird.gov.ai/Services/Tax/gst.