From pharaohs building pyramids for “eternity”1 to India’s Prime Minister saying infrastructure will underpin becoming a “developed” nation2 — to China’s Belt and Road trillions in loans throughout Asia, Africa and Latin America over the last decade3, nations have been investing in infrastructure for centuries.

Likewise in Europe, prodigious projects are nearing completion: from a hospital and tower in Portugal and Germany, to a French nuclear plant, a gas pipeline from Denmark to Poland – and the UK Crossrail.4 And, the US has a $1 trillion plan to “pour billions into the nation’s roads, ports and power lines.”5

Patriotic Pride in Projects

Across continents, such initiatives echo early Egyptians, who proudly built pyramids “to display the wealth and control of ancient pharaohs.”1 Some here have felt the same when seeing the ferry terminal, airport road, flowers along the main strip, and when Shoal Bay and Zemi roads – and the Jeremiah Highway — were newly paved.

Heuristics and the Highest Pyramids

Egyptians built over 100 pyramids, yet most of us only recall seeing three iconic “wonders of the world” and the Sphinx at Giza.6 Thus, lacking more information, we would likely demonstrate the “availability heuristic” and say “three” if asked how many pyramids were built!

“The availability heuristic is a cognitive bias in which you make a decision based on an example, information, or recent experience that is readily available to you, even though it may not be the best example to inform your decision” as described by Kahneman and Tversky in the 1970s. Also called “availability bias” whereby, events are “estimated by the ease with which relevant examples can be recalled.”7

This heuristic causes people to over-estimate the likelihood of a situation whenever less likely events are broadly reported, or perhaps, “viral” on social media. Examples might include celebrating lottery winners, instead of innumerable idle bets; having greater fear of flying than driving — or sharks than lightning, when the latter of both are more dangerous.7

Rating Governments by Roads — or 10 vs. 90% of Actual Spending!

Since we often see – and therefore, recall – the new terminal or road upgrades, we may experience the “availability heuristic” again and again! Like the proverbial tip of an iceberg, we may judge a situation while glimpsing but a sliver of its scale — or as if we recall only the “eye” above the pyramid on a US dollar bill, without seeing the pyramid!

Some might say, “…government did a good job with Blowing Point…” or “All those taxes are paying for better roads, and they’re putting flowers on them!” Similar heuristics no doubt arise from airport upgrades, wharf construction, or maybe soon, completed classrooms.

On average, only ~2.4% or $5.5M per year of our taxes have provided “local” infrastructure funding over the last 10 years. Whereas “external” sources have averaged ~$17.1Million per year, mostly as debt to Britain, CDB, or the European Development Fund (including allocations post-Brexit). With annual operational spending averaging ~$210Million over the period, even when combined with 3x as much offshore funding, an average of less than 10% of aggregate spending has been for public infrastructure, like roads, schools, or ports. Given that majority of external funding, we may actually be “rating” the British or the banks for such improvements, rather than our own government!8

If Not Roads, Where Do Our Tax Dollars Go?

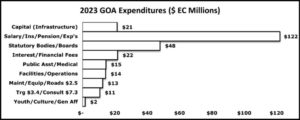

In 2023, government will spend ~$246Million (M), taxing over $20M from the People every month.

The chart helps us “see” how half our taxes go for staffing, or ~$122Million per year. That pays paychecks ($83.9M, plus $0.1M for “backpay”), raises ($3.9M), pensions ($11.6M), their health insurance ($8.7M), Social Security ($3.8M), allowances, expenses and travel, or about $10M per month.8

Next, in addition to fees we pay them, statutory bodies are given another ~20 cents of each tax dollar, including the health authority ($21.9M), tourist board ($8M), community college ($4.4M) and stipends for countless board members, totaling $47.9M, or ~$4M every month.8

Another ~10 cents of each dollar go to debt interest, “restricted expenditures” – refunds, claims against government, and GST, or nearly $2M per month.8

Another 10 cents go to public assistance ($13.4M), medical treatments and supplies (~$1.1M) – heavy equipment rental, maintenance, and roads ($2.5M/year), or a total of ~$2M per month.8

2023 infrastructure spending would rank here at $21M, nearly $2M per month. And, ~5 cents of each tax dollar pays for consultants ($7.3M), training ($3.4M) and about $2M for sports, youth, gender affairs and cultural development per year, combined.8

Seeing Past the “Eye” of the Pyramid on Our Tax Dollar Bills!

Whether from taxes, the British, or future debt, we must “see” that “…infrastructure projects are especially appealing to politicians as… a visible reminder to voters that the government is working…[but] concerned citizens need to be aware of the strengths and weaknesses of infrastructure as… stimulus… [and that it] is often heavily influenced by political and electoral considerations…”9

Indeed, we can give credit to workers — and local and UK governments — for recent improvements. However, GST and generational debt were nonetheless forced on us for a few nicer roads and buildings, from about 10 cents of every tax dollar, after years of failing to curb spending and build reserves — with a massive sargassum bloom — and storm season on the horizon.

And, beware of the “availability heuristic”! Like the eye on the US dollar bill, we “see” GST with every receipt, but it’s only the tip of our pyramid of taxes! We must “rate” government far beyond ports and classrooms. That is, to avert our own “availability biases” we must “see” the other 90% spent beyond our roads: from salaries, to boards, offices, equipment – some public assistance, and only ~1% each, for road maintenance and cultural development.

In fact, that “unseen” 90% of our tax burden is why GST must be repealed! They can change GST to any rate on any day whenever they want more! So, since we exceeded the goal before it began, we should “rate” our government on whether they repeal GST – and on advancing balanced budget legislation, not whether they plant pretty flowers on the road!

Demand repeal of GST – and a balanced budget bill. Now.

This article reflects cultural and economic issues raised on July 5, 2021, at the House Select Committee on GST Public Hearing. 1https://www.nationalgeographic.com/history/article/giza-pyramids; 2https://timesofindia.indiatimes.com/india/infrastructure-push-path-to-make-india-developed-pm-modi/articleshow/98419960.cms; 3https://www.wsj.com/articles/china-global-mega-projects-infrastructure-falling-apart-11674166180; 4https://www.planradar.com/gb/5-biggest-european-mega-projects/; 5https://www.nytimes.com/2021/11/15/us/politics/biden-signs-infrastructure-bill.html; 6https://www.heritagedaily.com/2021/01/the-ancient-egyptian-pyramids/134365;7https://www.simplypsychology.org/availability-heuristic.html; 8GOA Budgets, 2013 to 2023; pp. 11, 204-207 (2023); 9https://www.investopedia.com/articles/markets/080816/can-infrastructure-spending-really-stimulate-economy.asp