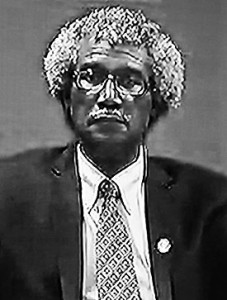

An Economic Review of the Eastern Caribbean Currency Union (ECCU) was delivered via video conference on Tuesday this week to Anguilla, and the seven other member territories, by Sir Dwight Venner, Governor of the Eastern Caribbean Central Bank (ECCB). A number of persons from the public and private sectors in Anguilla, including two sixth form students, were at the local Representative Office for the event.

Governor Venner spoke on the theme “Realism and Hope: Moving Towards Our Development Goals”. The review presentation focused on the following: Global and regional economic developments in 2013; the main challenges and accomplishments of the currency union over the year; and the top priorities for the ECCU over the near and medium term.

During question time, the member territories were each allotted three questions based on the Governor’s presentation. Those who spoke for Anguilla were Barrister-at-Law, Keesha Carty, Mr Sutcliffe Hodge and Mr Carl Harrigan. Mrs Carty’s question touched on banking and financial matters.

Governor Venner made the following statement: “What we have been examining over time, and what has been exacerbated by the global crisis, and hit particularly hard in Anguilla, as you know, is whether or not banks can be viable in a very small market space. We have found over time that this is going to be an extremely difficult challenge. Just by comparison, the major banks in the region – and I refer to such entities as FirstCaribbean International Bank, the Royal Bank of Canada and RBBT – are now in the process publicly of releasing workers and tightening up their activities because they are not doing very well. These are regional banks which branch throughout each country and already large, multi-national corporations. They not have [branches] only in our small region, but beyond, and they are finding it very difficult in the circumstances to make ends meet so to speak.

“Compare that with our banks operating in very small spaces, very small populations, very small markets, and project forward to see what the possibilities are. We will see already in Anguilla the circumstances, and in Antigua where we’ve had to intervene in banks. We had to do this because we have to protect depositors like yourselves. But, in terms of the future, all the banks in the domestic jurisdiction, have to get together to find common cause because the arithmetic is really not on our side. It is very, very important that we have domestic banks which can follow through with our own development projects – and our own development policies – and we stand in grave danger of not having that if we continue in the current mode.”

It was announced in Anguilla on Monday, August 12, 2013 that the ECCB had taken control of the two indigenous banks: the Caribbean Commercial Bank and the National Bank of Anguilla, for a period of six months in the first instance. The takeover was done with the support of the Anguilla Government, the British Government, the IMF and the World Bank.