In these turbulent times, it was easy to miss that a UK Labour candidate in Rochdale, was “disowned” by the Party in mid-February. He made statements based on an “online conspiracy theory” from which he later distanced himself, but which inevitably forced a withdrawal of Labour support.[1]

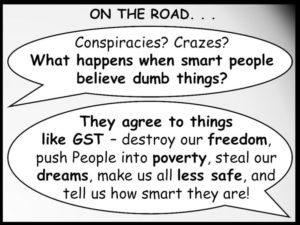

Conspiracies: When Smart People Believe Dumb Things

As the Rochdale fallout was falling, another Guardian columnist, Gaby Hinsliff, offered intriguing insights to societal dangers “when smart people believe dumb things…because [conspiracy theories] are not victimless beliefs.”[2]

Her examples were instructive. She cited the “potential to cost lives in an outbreak” from anti-vaxxer “nonsense” and violence associated with pizza parlour madness. She also warned of AI-generated “deepfake” deceptions becoming “more slick and convincing, capable of fooling even the most sophisticated” people.[2]

Costly Crazes: Better Known as Bubbles

An “asset bubble occurs when the price of a financial asset or commodity rises…well above either historical norms, intrinsic value, or both.” Analogous to conspiracy theories, such bubbles typically form when “justified by the flawed assumption that an asset’s intrinsic value has skyrocketed” without any rational basis in fact.[3] When burst, resulting crashes can be catastrophic.

An “asset bubble occurs when the price of a financial asset or commodity rises…well above either historical norms, intrinsic value, or both.” Analogous to conspiracy theories, such bubbles typically form when “justified by the flawed assumption that an asset’s intrinsic value has skyrocketed” without any rational basis in fact.[3] When burst, resulting crashes can be catastrophic.

One early example was “Tulipmania” – when a “wide cross section of the Dutch population” was swept into financial ruin in the 1630s when otherwise humble, dormant flower roots led to staggering speculation. Prices for some single tulip bulbs “exceeded the price of some houses” before wilting 99% by May 1637.[3]

Shattered Shareholders: From the South Sea to Wall Street

Three of the most devastating debacles befell stock investors, beginning with the siren song of the South Sea Bubble in 1720. “Unimaginable riches” were rumoured to await those expecting a UK trading monopoly with South America, as shares climbed from £125 to £950 before shredding in mere months.[3]

Two centuries later, speculators were wiped out when the soaring US stock market lost nearly 25% of its value in just two days in 1929. It eventually fell 89% over the next three years. That crash was the seminal event for the Great Depression of the 1930s.[4]

A third stock shock was the “Dot-com” delusion of the 1990s in which a “new economy” of Internet businesses led to “multi-billion dollar valuations” for companies offering new listings for public trading. This catapulted the NASDAQ index from “about 750 to over 5,000 by March 2000” followed by a 78% crash that precipitated a US recession.”[3]

Real Recessions from Real Estate

Yet another “mistaken belief” led investors to view real estate as a “safer asset class” than paper stock certificates. In the late 1980s, a real estate bubble tripled metropolitan land prices following a Japanese government stimulus program. Its impact was epitomised by driving the “Imperial Palace grounds in Tokyo [to exceed] the value of real estate in the entire state of California.” Ultimately, its implosion ushered in the Lost Decade of Japanese deflation and stagnation. [3]

And, after a rapid rise from 2002, a period of US housing hysteria peaked in 2006. By 2009, values toppled by a third. That tumble was accelerated by the “down payment” leverage of a mortgage that can rapidly erase equity in real estate, creating “toxic loans” where debts exceed market values. These dynamics compounded into the meltdown of mortgage-backed securities that forced the bailout of major US banks and led to the Great Recession.[3] Sound familiar?

A Budget Bubble?

In 2022, yet another “flawed assumption” swept Anguilla into a global spending spree with GST. While it was the only British Overseas Territory to fall, we toppled into tax tyranny along with 174 other countries – all sharing the delusion of drawing from an infinite pool of public tax dollars![5] Wow! Imagine the global gains from telling everyone again and again to “Shut up and pay your taxes!” Amazing.

Such assumptions have seemingly shaped our largest-ever budget this year, fueled by studies like one concluding “that if GST is introduced, the revenue base of [India] will increase”[6], and reporting that “UK tax revenue is forecast to reach its highest ever level” in 2024. That news was attributed in part to, “One major trend since the 1970s [that] has been a shift towards VAT.”[7]

But. Impatient plans for pocketing the public purse may be approaching a tipping point, at least in the UK. By the end of 2023, overspending led to “nearly one in five council leaders in England [saying] they are likely to declare de facto bankruptcy [in 2024] as a result of a lack of [central] government funding.”[8] That is, subsidies were no longer sufficient for local shortfalls, and there were no safeguards to prevent overspending.

See a pattern here? You know, by the same “good governance” overlords who kept hiring people, approving unsustainable budgets, merely gaped as gaps engulfed us in debt traps, and then dictated new taxes, like GST – deep in the pandemic?

Crazed Collections and the Next Crash?

UK taxpayers already pay Value Added Tax (VAT), Personal Direct Taxes, Income Tax, Capital Gains Tax, National Insurance Contributions (NICs), Inheritance Tax (IHT), Indirect Taxes and Duties, Insurance Premium Tax, Excise Duties, Stamp Duty and Property/Land Taxes, Taxes for Businesspeople, Income Tax for Sole Traders, Taxes on Dividends, Capital Gains Tax on Business Sale, Council Tax (now looking dire), Tax on Vehicles – and more![9]

After plucking every penny, what’s left to avert a crash – or has it started? While nonetheless expecting an historic tax haul, the UK “economy fell into recession at the end of last year, as hard-pressed households cut back on spending amid the cost of living crisis”[10] – a cost of living that includes an increasing government share devouring funds for feeding their families!

We are living the consequences of smart people believing dumb things. As they gloat, all appear blind to our losses when forced to pay for their gains. At what point could profits be so pitiful, price and trade controls so tight, and crime so high that Anguilla’s economy – and its crazed tax collections – crash from these hysterical heights, as they already have for so many families? By extension, if VAT is inspiring such illusions of infinite increases worldwide, when exactly will the global VAT bubble burst? Anguilla can and must escape this fate. As the first territory to fall, she must be first to rise…

Repeal GST. Now.

This article reflects issues raised on July 5, 2021, at the House Select Committee on GST Public Hearing. [1] https://www.theguardian.com/commentisfree/2024/feb/14/labour-azhar-ali-rochdale-byelection; [2] https://www.theguardian.com/commentisfree/2024/feb/16/rochdale-azhar-ali-israel-conspiracy-theories-labour; [3] https://www.investopedia.com/articles/personal-finance/062315/five-largest-asset-bubbles-history.asp; [4] https://en.wikipedia.org/wiki/Wall_Street_Crash_of_1929; [5] https://www.vatcalc.com/global/how-many-countries-have-vat-or-gst-174/; [6] https://thescholedge.org/index.php/sijmas/article/view/207/307; [7] https://ifs.org.uk/taxlab/taxlab-key-questions/how-have-government-revenues-changed-over-time; [8] https://www.ft.com/content/82a841b1-fec7-4ed9-bfae-cfbb537c6b38;[9] https://blog.shorts.uk.com/list-of-taxes-for-uk-individuals; [10] https://www.theguardian.com/business/2024/feb/15/uk-recession-consumers-cut-spending-gdp