Most everyone has heard the expression an “elephant in the room” – first cited in an 1814 fable about a man who noticed “tiny” things in a museum yet failed to notice an elephant. The phrase refers to “an important or enormous topic, question, or controversial issue that is obvious or that everyone knows about, but no one mentions or wants to discuss because it makes at least some of them uncomfortable and is personally, socially, or politically embarrassing, controversial, inflammatory, or dangerous.”1 In Anguilla, crime has always been an “elephant in the room” as a tourism destination. However, it seems the most likely cause of recent spikes may, itself, be an “elephant in the room.”

Poverty and Crime

In a study of violent crime and poverty in 30 US cities, they found that higher income and employment levels were consistent with lower crime rates – and vice versa. Perceived deprivation and societal alienation associated with inequalities also corresponded to higher rates of crime. Ultimately, they found “… a direct correlation between poverty and violent crime rates…” and the author concluded, “Since poverty is directly linked to violent crime rates…we can stop violent crime through poverty reducing projects or initiatives.”2 Hmm… so repealing GST could reduce crime by 13%?

Financial Security Fosters Physical Security

These relationships may also be explored on the upside. While often dismissed as a utopian delusion of politicians like Andrew Yang, who ran for US president in 2020, universal basic income has been studied to assess its impact on crime and violence, especially the domestic component of violent crime. Seeking to eliminate poverty, this social experiment was conducted in Canada for an entire town for 3 years. Not surprisingly, they found a “robust and significant negative relationship between the guaranteed income and both violent …and total crime rates.” Despite acknowledging systematic under-reporting of domestic violence, a combination of reduced financial stressors and economic empowerment to exit abusive relationships significantly reduced the intimate-partner share of violent crime as a result of greater financial security. How much? Providing financial security resulted in a 58% decrease in violent crime, or 350 compared to an average of 600 per 100,000 people. For overall crime, a drop of ~1,400 from 8,000, or an 18% decrease was also observed.3

Lotteries and Crime…

Perhaps we have a bright yellow “baby elephant” wandering our villages, considering its potential impact on crime according to an analysis of the US states that adopted lotteries as a form of taxation. The analysts found that lottery revenues are collected disproportionately “from low-income people… [whereby] the pattern of play works like a regressive tax to the relative detriment of low-income individuals…” The final analysis showed that states with lotteries had 112.7 more property crimes per 100,000 people, or a 3% contribution to property crime when isolating lotteries from other factors.4

…and Regressive Taxation in All Forms

These findings remind us that Value Added Tax (VAT) – and Goods and Services Tax (GST), another name for the same scheme, are “regressive” and impact people with lower incomes the hardest. For example, the top fifth of the UK income scale paid 9.1% in consumption taxes such as VAT (UK term for GST); whereas those in the bottom fifth paid 22.9% of their income on such taxes.5 Regressive taxes also include Customs duties, and all fees charged at the same rates for all taxpayers.

Still, the most comprehensive work linking taxation and crime has remained an “elephant in the room” for the last decade, as efforts to advance GST were hidden from view by our last three administrations. We have been warned that…

“… after factoring out all other explanations — like racial composition, poverty rates, the amount spent on education or health care, the size of the state’s economy, existing inequality levels, and differences in the cost of living — the relationship between taxing the poor and negative outcomes like premature death persisted. For every $100 increase on taxes at the poverty line, we saw an additional 7 deaths and 78 property crimes per 100,000 people, and a quarter of a percentage point decrease in high school completion.”6 [as well as 12 violent crimes per 100,000]7

This work also reported that states with higher regressive taxation “…have far higher rates of strokes, heart disease and infant mortality …Students drop out of high school in larger numbers. These outcomes are not just a consequence of a love of fried food or higher poverty levels. Holding all those conditions constant, the poor [in such states] …do worse because their states tax them more heavily. They have less money to buy medication, so their health problems get worse. High sales taxes make meals more expensive, so they shift to cheaper, unhealthy food. If people can’t make ends meet, they may turn to the underground economy or to crime.”6

The Elephant in Anguilla: The Crime of GST

Logically, if doing something is harmful, doing more of it is more harmful. When taking over twenty million dollars per month ($20,000,000.00) from the rest of us, regressive government duties and fees have disproportionately impoverished our most vulnerable households. Adding GST made our situation 13% “worse” in each of these social dimensions, as seen in the US Southern states. Why would crime be any exception?

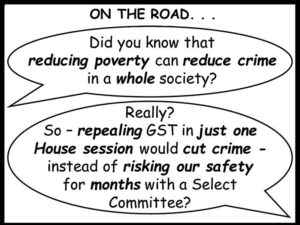

Tragically, in response to recent, particularly violent crimes, forming another “Select Committee” nonetheless suggests blindness to the “elephant” in Anguilla.8 How? Well, let’s consider the impact from just $100 of higher tax per household: For 15,000 of us, we risk 1 more death, 2 more violent crimes, and 12 more property crimes for every $100 of increased taxes per household – and up to 17 property crimes thanks to having a lottery in every village. GST is taking far more than that. And… What makes anyone think this Select Committee won’t ignore the People like the last one? And risk 3 months of our safety until a report in September – that everyone will ignore?

Great leaders would do the right thing: Repeal GST ? and replace the robust taxes it renamed ? in a single session of the House. That would improve financial security for every vulnerable household by 13%. And make Anguilla a safer place for everyone.

Repeal GST – and pass a balanced budget bill. Now!

This article reflects cultural and economic issues raised on July 5, 2021, at the House Select Committee on GST Public Hearing. 1https://en.wikipedia.org/wiki/Elephant_in_the_room; 2Quednau, Joseph (2021) “How are violent crime rates in U.S. cities affected by poverty?” The Park Place Economist: Vol. 28; 3Calnitsky, David, and Pilar Gonalons-Pons. 2020. “The Impact of an Experimental Guaranteed Income on Crime and Violence.” University of Pennsylvania Population Center Working Paper (PSC/PARC), 2020-56; 4https://www.jstor.org/stable/3487504; 5https://www.ons.gov.uk/peoplepopulationandcommunity/personalandhouseholdfinances/incomeandwealth/bulletins/theeffectsoftaxesandbenefitsonhouseholdincome/financialyearending2021; 6https://archive.nytimes.com/opinionator.blogs.nytimes.com/2013/03/09/in-the-south-and-west-a-tax-on-being-poor/; 7Newman, K.S, and O’Brien, R.L. Taxing the Poor: Doing Damage to the Truly Disadvantaged (Univ. of California Press, 2011); 8“Bi-partisan Select Committee Formed in House of Assembly to Tackle Gun Violence” (The Anguillian; 25 May 2023; Vol. 25, No. 25).