A most powerful and eye-opening presentation on the above topic was delivered by Ms. Melinda Goddard, MBA, to the Goods and Services Tax (GST) Select Committee. She was invited to speak at the fourth and final day of the public hearings on Monday, July 5, 2021.

Ms Goddard presented alternatives to the GST, primarily proposing that Government repeals and replaces the GST with a balanced budget law to meet the requirements of a pending CDB loan. She opened by asking, “Are we to become a nation of tax collectors…working to pay Inland Revenue every day (or else!)?”

Ms. Goddard also cited the reference to a “17% rate” in the 2019 budget – and nearly $11million of higher personnel costs associated with implementing the GST in 2022 projections. If repealed, and those staffing costs were saved, existing taxes could be used to raise $11 million, instead of struggling to raise $22 million by charging 17% more on all goods and services. She also identified “outside” and “miscellaneous” expenses that exceeded $22 million. These amounted to 10% of the current $226 million budget. These could more than cover $11 – or up to $22 million – without a layoff of public servants, and without a penny of new taxes!

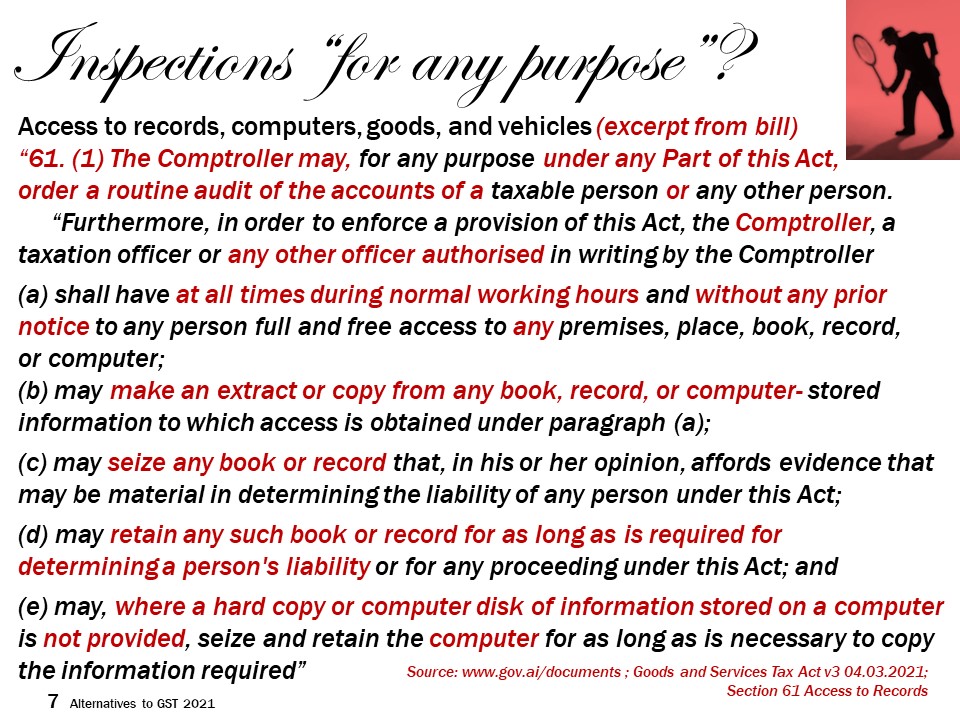

Following examples of how the GST is imposed, Ms. Goddard read Section 61 of the draft law. “Inspection for any purpose” emphasises the cultural intrusiveness of the GST, or any tax that demands inspections of individual business records (e.g. sales tax, VAT – and income tax for entrepreneurs where business details of income would be open to civil servant inspection).

She also cited a total of 22 “unstipulated regulations” throughout the bill. Any Minister of Finance would be free to make future increases or changes at will, without public consultation. They include: the rate of the GST, registration requirements and numerous other aspects of the tax. However, a total of 27 sections of the bill detail a long list of serious criminal and civil penalties for non-compliance ranging up to $100,000 and 5 years in prison. Thus, the bill is vague as to what to do and clear on the penalties for not doing it.

Ms. Goddard also summarised the social impact from regressive taxation, such as GST. She noted such taxes do the greatest harm to those living on paycheck to paycheck. If the GST goes forward, upwards of 1,000 private sector jobs could be lost – as businesses struggle to pay the tax, pay accountants to avoid penalties, and/or lose business from attempting to raise prices.

Ms. Goddard concluded with a series of additional ways to develop the economy, such as “academic tourism” and to achieve world class efficiencies in the Anguilla Public Sector.

The full presentation is accessible at the “Anguilla House of Assembly” Facebook page as Day 4 of the Select Committee on the Goods and Services Tax hearings, July 5, 2021.