Wednesday, May 29th, saw the launch of the Eastern Caribbean Fifty- dollar polymer notes, presided over by Governor Timothy Antoine of the Eastern Caribbean Central Bank, via a simultaneous video-conferencing broadcast to all ECCB member countries.

From the ECCB offices in Grenada, Governor Antoine took the initiative to officially release the notes, starting with the introduction of the fifty-dollar bill. Pertinent extracts of the Governor’s address follow:

“As always, I am delighted to be in the Isle of Spice. Today, I am especially pleased to mark this visit with the launch of our highly anticipated EC polymer notes. Before I continue with my brief remarks, I hereby confirm that our EC dollar is strong. As of Friday, May 24th 2019, the backing ratio was 98.4 percent. More importantly, our foreign reserves continue to grow, and they now total US$1.75 billion. As we celebrate the strength of our currency let me be very clear: The ultimate defense for our strong EC dollar is our production.

“It is through the production of goods, and especially services, that we will earn our way in the world, enhance our capacity to finance and determine our development scope and trajectory, reduce public debt, and deliver shared prosperity for the citizens of the Eastern Caribbean Currency Union (ECCU).

“Today marks another milestone in the ECCB’s Strategic Plan 2017-2021, styled ‘Transforming the ECCU Together’. As an ECCU citizen or resident, if you are not familiar with this Plan, I invite you to visit our website (www.eccb-centralbank.org). Familiarize yourself with the Plan, and become an implementation partner.

“Strategic Plan implementation aside, I confess my relief to finally settle questions that have been posed to me not only here in Grenada, but throughout the Currency Union: ‘When will we see EC notes that bear the signature of the current Governor? Why are we moving from paper to polymer?’ Simply put, we are moving away in order to enhance the security and usability of our EC notes.

“It is amazing to observe how commerce, banking and money have evolved over the past 3,000 years. From barter to bitcoin; from private money to central bank money; and, now, crypto assets. Notwithstanding this long history, the fundamentals of money have not changed. Stripped to its core, money is based on trust and has three basic characteristics: unit of account, store of value, and medium of exchange.

“To maintain trust and to stay ahead of counterfeiters, our Central Bank has a duty and an obligation to care for the continual upgrade of our notes. But our motivation is also personal. On several occasions, I have had fishermen and vendors lament to me, their inability to get value for their notes which were soiled or torn. These stories have affected me. I have asked myself how can our Central Bank help to ensure that these hardworking folks get full value for their hard-earned money? I believe polymer will greatly ease this hardship.

“From an economic standpoint, polymer notes are more cost-effective than paper. Although polymer notes are more expensive to produce upfront, their extended lifespan means that the notes are replaced less often. Consequently, there will be a reduction in transportation and handling costs thus reducing the overall cost of cash for the ECCB, commercial banks and credit unions. As part of our due diligence, the ECCB consulted with colleagues from the Bank of England, the Bank of Scotland and the Bank of Canada on their experiences with changing from paper to polymer.

“Compared to paper notes, polymer notes are: • Cleaner: resistant to dirt and moisture; • More secure: they have advanced security features which make them harder to counterfeit; • More durable: they last at least three times longer; and • More environmentally friendly. Consequently, fisher-folks, vendors and the people of the ECCU will soon have, in their hands, banknotes that are cleaner, safer and stronger.

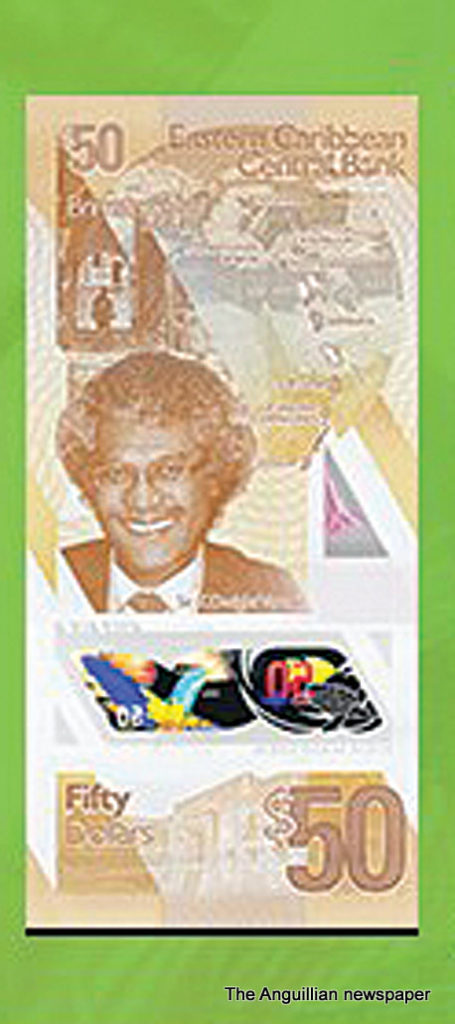

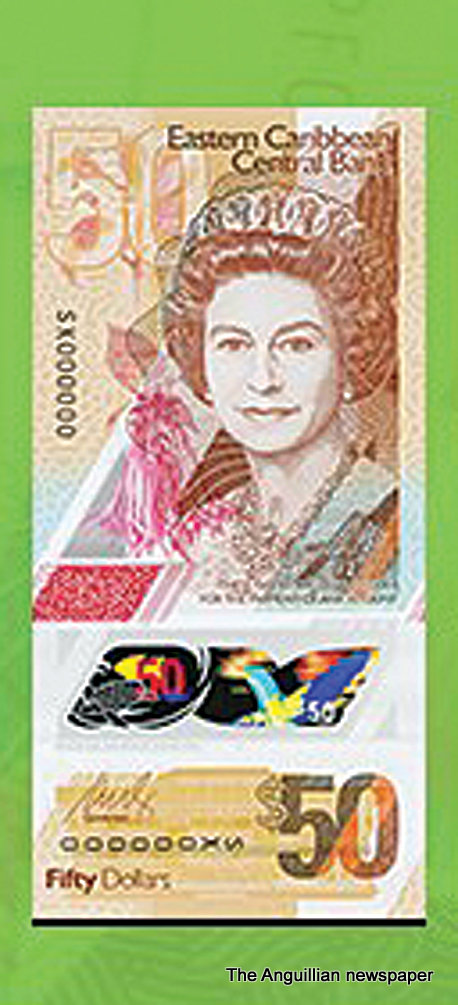

“The switch to polymer necessitated some changes to the designs of the notes in respect of technical and security specifications. However, even with these new design elements, we were careful to maintain a degree of familiarity for ease of use. Very importantly, we have incorporated a feature (raised bumps) to make it easy for the blind and visually impaired to handle their money and their business.

At this juncture, I wish to recognize the advocacy of John Rullow who, a decade ago, approached the Ministry of Finance in Grenada and made an appeal for features that catered for the blind and visually impaired. In our launch today, we unveil the first note in the EC family of notes – the EC$50.

“This new note bears the image of our late, great Governor, the Honourable Sir K Dwight Venner. Once again, I hail the colossal contribution of my illustrious predecessor. We are particularly pleased that Lady Venner has been able to join us for this special occasion. We wish to publicly thank Lady Venner and her family for their enormous sacrifice and support in sharing Sir Dwight with the people of the Currency Union, as Governor, for more than a quarter of a century.”

Gov. Antoine informed the conference that the full transition of paper to polymer will be taking place in phases. He said: “As unfit paper notes are returned to the Central Bank, and our current inventory of paper notes is depleted, they will be replaced by polymer notes. Therefore, the public ought to expect that both paper and polymer notes will be in circulation at the same time.”

He assured the public that both the paper and polymer notes would be legal tender, and projected that the $100, $20 and $10 notes will be issued around September of this year and the $5 note around September of next year.

– Staff Reporter, James R. Harrigan